|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

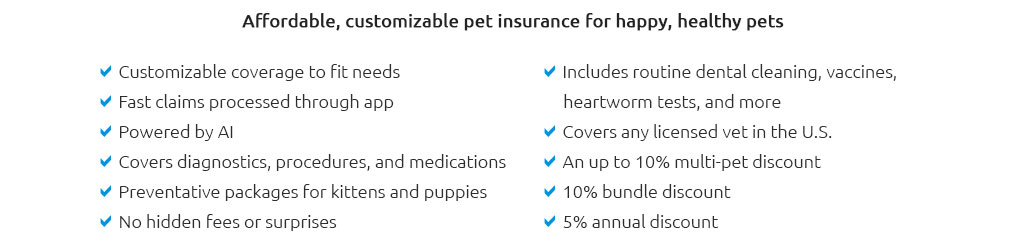

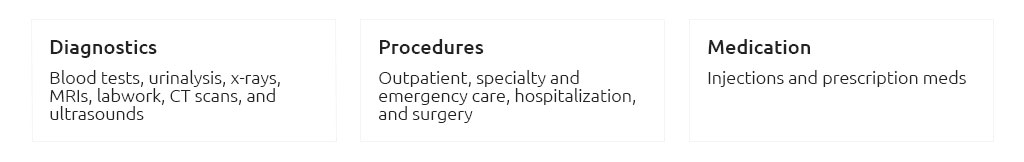

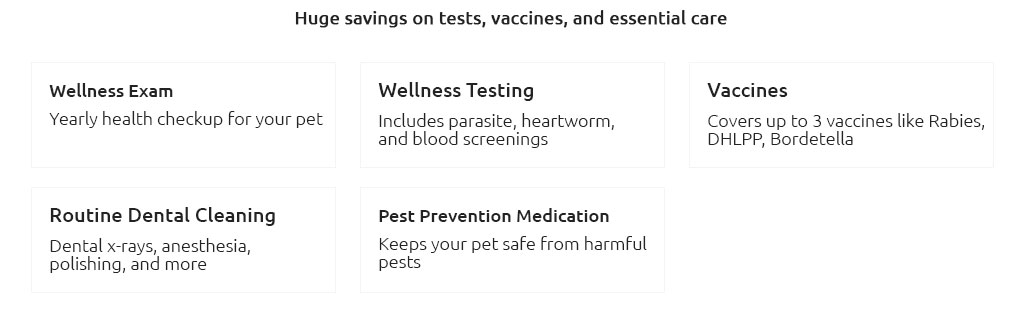

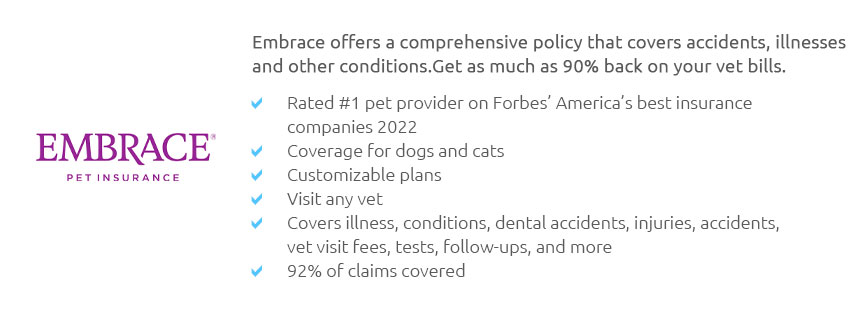

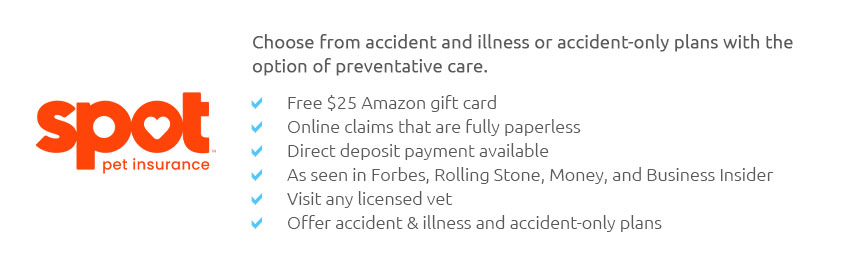

Pet Insurance Price Comparison: A Comprehensive GuideIn today's world, where pets are cherished members of the family, ensuring their health and well-being is paramount. Pet insurance has emerged as a popular option for pet owners who want to manage potential veterinary expenses effectively. However, navigating the plethora of options available in the market can be daunting. This article delves into the intricate world of pet insurance price comparison, offering insights that could help you make an informed decision. To begin with, pet insurance policies vary widely, not only in terms of price but also in coverage. It is essential to understand that the cheapest policy may not necessarily provide the best value. Factors such as coverage limits, deductibles, and exclusions significantly impact the overall cost-effectiveness of a policy. Therefore, while comparing prices, one should adopt a holistic approach, considering all these elements. A key consideration is the type of coverage you desire for your furry friend. Most insurance providers offer a range of plans, from basic accident-only coverage to comprehensive policies that include wellness checks, vaccinations, and even dental care. Accident-only plans are typically more affordable but may not cover illness-related treatments, which can be costly. On the other hand, comprehensive plans, though pricier, offer peace of mind by covering a broader spectrum of potential health issues. When comparing prices, it is also vital to consider the deductibles and reimbursement levels. A higher deductible usually results in lower premiums, but it means you will pay more out-of-pocket before the insurance kicks in. Reimbursement levels, often ranging from 70% to 90%, dictate how much of the vet bill will be covered after the deductible. Balancing these factors according to your financial situation and your pet's needs is crucial. Another important aspect of pet insurance is the exclusions. Many policies do not cover pre-existing conditions, hereditary disorders, or specific treatments. Reading the fine print can save you from unpleasant surprises down the line. Additionally, some insurers offer discounts for insuring multiple pets or for renewing policies without any claims, which can be a smart way to reduce costs.

In conclusion, while pet insurance price comparison can seem like a daunting task, breaking it down into manageable steps can make the process smoother. By carefully evaluating coverage options, understanding the nuances of deductibles and reimbursements, and factoring in potential exclusions, you can select a policy that offers the best balance of cost and coverage for your beloved pet. Remember, the goal is not just to find the cheapest option but the one that provides the greatest value and peace of mind. After all, our pets depend on us to make the best decisions for their health and happiness. https://wagwalking.com/wag-wellness/pet-insurance

Uncomplicate picking your pet insurance with Wag! Wellness. Compare top pet insurance providers to see what's covered, cost, health expenses, reviews, ... https://www.petinsurancereview.com/dog-insurance

Typically speaking, dog insurance costs more than cat insurance because dogs are usually larger, which makes them require more in the way of medications, ... https://www.moneygeek.com/insurance/pet/

Compare Pet Insurance Quotes by Company and Coverage - 1. 24 Pet Watch. $39.03. $51.95 - 2. ASPCA. $26.54. $49.27 - 3. Embrace. $30.15. $42.75.

|